Riyadh municipality in Saudi Arabia has partnered with IBM to jointly design a blockchain strategy to improve services in the government sector

Rememberful Bitcoin News.

Riyadh municipality in Saudi Arabia has partnered with IBM to jointly design a blockchain strategy to improve services in the government sector

Riyadh municipality in Saudi Arabia has partnered with IBM to jointly design a blockchain strategy to improve services in the government sector

A home in Delaware sold for USD 1.35 million of Bitcoin on 6 July 2018, which would be approximately BTC 208 at the time of sale. This is not only the first time a house has been sold for Bitcoin in Delaware, but also the first time in the entire Northeast United States. This is …

The post First Home Sold for Bitcoin In Northeast United States appeared first on BitcoinNews.com.

A home in Delaware sold for USD 1.35 million of Bitcoin on 6 July 2018, which would be approximately BTC 208 at the time of sale. This is not only the first time a house has been sold for Bitcoin in Delaware, but also the first time in the entire Northeast United States. This is another example of how Bitcoin can be used as a currency even when dealing with large amounts of money.

The home is on a 4.2-acre plot of land in Newark, Delaware and is big enough to be considered a mansion. It has a theater, wine cellar and a pool. The real estate agent who sold it, who works for the MAK group, says, “I sold the Bitcoin house! Not only the first property offering Bitcoin payment support in Delaware, but the entire North East region and one of the only properties in the world. As I continue to scale a growing real estate practice across three, soon five states. I look forward to further disrupting an industry stuck in the 20th century.”

Although Bitcoin real estate deals are rare, news stories about them are becoming more frequent. The largest Bitcoin real estate deal in history occurred in Miami, Florida in early 2018. Then, BTC 455 worth USD 6 million at the time were traded for a 7-bedroom mansion. Hotel mogul Richard Hilton is accepting Bitcoin for a USD 44 million mansion in Rome called the Palazzetto, but US dollar is an option as well so it remains to be seen whether this will become the biggest Bitcoin real estate transaction in history. There have been several Bitcoin real estate deals around USD 1 million, like this home in Delaware, and overall about 20 homes have been sold in the last year in this way.

It is somewhat risky to conduct large transactions like real estate deals with Bitcoin due to market volatility, but other than that, Bitcoin is a fast and extremely secure means of payment. Services like BitPay which convert Bitcoin to fiat at the time of sale can insulate merchants and property owners from market volatility when transacting Bitcoin.

Follow BitcoinNews.com on Twitter at https://twitter.com/bitcoinnewscom

Telegram Alerts from BitcoinNews.com at https://t.me/bconews

Image Courtesy: Pixabay

The post First Home Sold for Bitcoin In Northeast United States appeared first on BitcoinNews.com.

The CFTC is wrapping up its case against accused fraudster Patrick McDonnell – but the hearings in New York this week have been anything but simple.

The CFTC is wrapping up its case against accused fraudster Patrick McDonnell – but the hearings in New York this week have been anything but simple.

A new task force created by Donald Trump seeks to further investigate “cyber fraud” and “digital currency fraud,” as per an executive order from the U.S. President and his administration. Trump Looking at Crypto The announcement, made today, looks to place digital currencies amongst more traditional crimes like money laundering and fraudulent investment schemes targeting…

The post Donald Trump’s US Government to Focus More On Crypto-Related Fraud appeared first on NewsBTC.

A new task force created by Donald Trump seeks to further investigate “cyber fraud” and “digital currency fraud,” as per an executive order from the U.S. President and his administration.

The announcement, made today, looks to place digital currencies amongst more traditional crimes like money laundering and fraudulent investment schemes targeting the elderly as a focus for the administration, as reported by Bloomberg. The move is representative of the fact that — despite occasional positive sentiments from U.S. financial watchdogs — as of late, digital coins are increasingly on their radars.

“Fraud committed by companies and their employees has a devastating impact on American citizens in the financial markets, the health care sector, and elsewhere,” Deputy Attorney General Rod Rosenstein said.

The task force brings together the Justice of Department (DoJ), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CTFC) — groups that have been ordered to focus more of their resources on scams tied to cryptocurrencies. In recent months, these U.S. regulatory bodies have issued crackdowns and warnings to investors about potential dangers associated with fraudulent cryptocurrency-related operations.

Despite the fact that the Obama administration formed a similar task force in the wake of the 2008 financial crisis, Trump’s choice to create his own allows his administration to further direct its agenda. In the executive order, Trump has tasked the group with providing guidance for investigations amongst the DoJ, SEC, and CTFC, as well as recommending ways to improve cooperation amongst the agencies.

Trump’s order, albeit worrisome, could in fact mean good things for certain crypto-related businesses. As Rosenstein reiterated, the order will allow the agencies to better coordinate their various probes to avoid “piling on,” or assessing several fines on a single company for the same violation. Rosenstein also said the goal is to give firms an incentive to cooperate with investigations and voluntarily report misconduct.

The creation of the task force comes as the Trump administration is moving to overhaul the Consumer Financial Protection Bureau (CFPB), which, as noted, was formed after the 2008 financial crisis in attempts to better protect consumers from predatory mortgage lending and unfair credit card contracts.

With regards to Bitcoin and cryptocurrency, attorney general and ambassador to the Trump administration Jeff Sessions said in October:

“The FBI’s very concerned about [the dark web]. They did take down, I think, the two biggest, dark web sites. This last one, Alphabay, we took down recently. They had 240,000 sites where individuals were selling, for the most part, illegal substances or guns on that site, including Fentanyl. And, they use bitcoins and other untraceable financial capabilities, and it is a big problem.”

Since then Sarah Sanders, White House press secretary and another Trump mouthpiece, has clarified further, saying Bitcoin and the crypto ecosystem is being “monitored:”

“[Bitcoin] is something that is being monitored by our team – Homeland security is involved. I know it’s something that [Trump]’s keeping an eye on. And we’ll keep you posted when we have anything further on it.”

Featured image from Shutterstock.

The post Donald Trump’s US Government to Focus More On Crypto-Related Fraud appeared first on NewsBTC.

Every month more than 300 ICOs are listed on ICObazaar. In May 91 ICOs closed public sales raising $ 2,5 bln. In Part 1 we give data on the main trends of ICO process: duration increases and more funds are coming from private and pre-sales. Part 2 is an overview of emerging fundraising methods, marketing […]

Every month more than 300 ICOs are listed on ICObazaar. In May 91 ICOs closed public sales raising $ 2,5 bln. In Part 1 we give data on the main trends of ICO process: duration increases and more funds are coming from private and pre-sales. Part 2 is an overview of emerging fundraising methods, marketing and legal aspects.

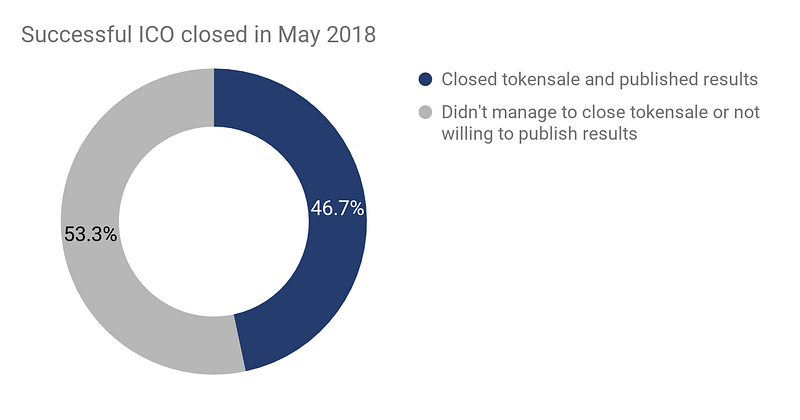

Less than half of declared tokensales report reaching goals

In 2017 according to TokenData and FabricVentures report from 913 projects that had tokensale, only 435 (48%) were successful raising $5,6 bln. 131 (14%) didn’t survive this stage 347 (38%) ICOs stayed unreported with no data displayed and even websites disappearing. As a result — low trust to blockchain industry.

In 2018 the hype is over. Less startups assume they need an ICO and industry tends to get realistic. Laws and regulations are emerging, everything tends to come in order to protect investors and give project teams a more powerful foothold for development.

In May 2018 there were 195 ongoing ICOs on ICObazaar planning to close sales. In fact only 91 public sales were closed with $ 2 566 588 843 raised.

The average duration of projects in May 2018 was 42 days. While 51% of ICOs prefer to close token sale within one month, others tend to organize longer sales in several stages.

Source: Icobazaar.com

In May 2018 195 projects planned to close coinsale and only 91 did.

Source: Icobazaar.com

ICO duration increases

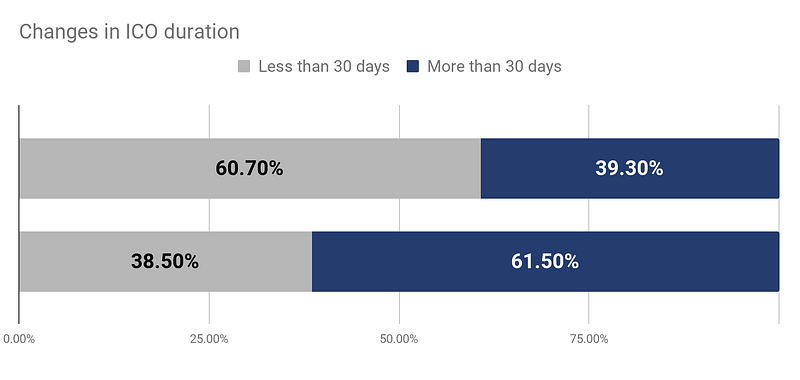

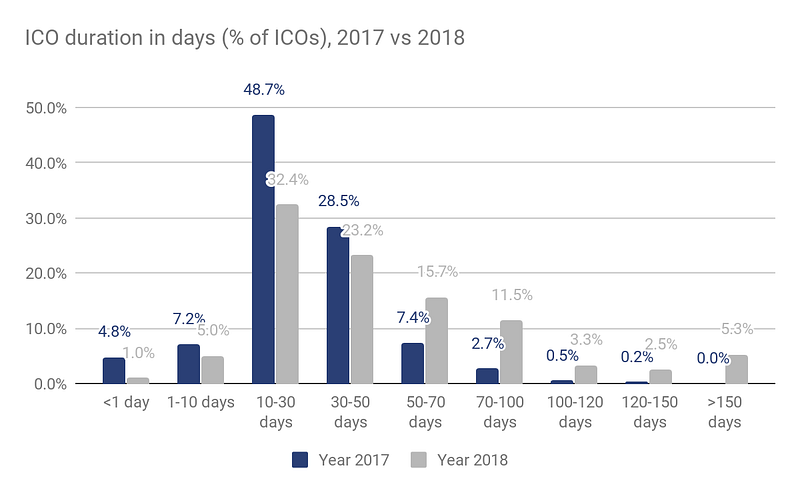

In 2017 60% of all projects planned ICO to last less than a month. In 2018 61% of ICOs are planned for 30+ days and divided it into 3+ stages with different discount programs. 10% of ICO last more than 3 month (public sales only).

Source: ICOBazaar

In 2018 the duration of projects significantly increases. If in 2017 only 39% planned to sale coins for more than a month, in 2018 61,5% act this way. More and more teams initially lay pre-ICO, and then 3 or more stages of sales. In the conditions of substantially increased competition the duration of marketing preparations increases. Also considering examples of extremely successful super long ICO (like EOS) more projects choose to extend ICO.

More projects start with private sale

Today it becomes a standard to conduct private sale before public sale. Nearly 30–35% of tokens with large discount (up to 50%) will go to crypto funds and angel investors. Projects use the money to fund pre-ICO campaign including marketing and social media advertising.

Data shows that 84% of all ICO fundraising this year has come from private and presales.

Pre-ICO allows to check test the product idea, get community feedback and gain awareness and interest without spending money on a full-scale promotion. On a pre-ICO a project can raise $2–3 mln and be ready to go worldwide.

New fundraising forms: STO, DAICO, IICO, CTM

More and more market players admit that the title “ICO” itself is compromised. While part of the projects leans toward STO, others prefer new forms of crypto crowd sales like DAICO, Interactive Coin Offering or Continuous Token Models.

Security Token Offering (STO) is held when token is backed by real assets or profits or company revenue. These tokens are protected from speculations and scammers, more like a traditional security, but in electronic form. Moreover, such a token meets all requirements of the U.S. Securities and Exchange Commission (SEC), which allows it to completely legally implement the token sale in the USA. The first security token platform Polymath data shows that STO will prevail on the market by 2020 and will be more than $10 trl.

(Source: Polymath, 2018)

DAICO is a hybrid solution of ICO and DAO, a model that allows the company to attract a solid investment, but at the same time provide investors with certain levers of management. It was Ethereum founder Vitalik Buterin who suggested this modification in order to improve ICO processing.

Interactive Coin Offerings is a protocol from creators Jason Teutsch and Vitalik Buterin that suggests a slightly different model of crowdsale that ensures certainty of valuation and participation at the same time. Dynamic mechanism then determines the desired number of purchases for each valuation, which leads to the final price that must satisfy both goals.

Continuous Token Models assumes that “instead of pre-selling tokens during a launch phase, the tokens are minted as needed through various means. The tokens are then dispensed for services rendered in the network”. Such continuous token models could enable small issuer specific bounty networks as well as an ongoing generation of non-fungible assets.

The idea is not enough, the product matters

In 2018 a steep roof-like idea does not automatically mean success anymore. “Game-changing” or “decentralising everything” is not the key. The product should meet industry demands, be scalable and integrative. The team must be strong and experienced, have notable advisors onboard and and a clear vision on funds spendings proved by a clear roadmap. Can I see the code on Github? No? Next!

Legal and Marketing

If in 2017 it was possible to start an ICO without hiring a lawyer, today more and more projects will undergo regulation and issue security-tokens, which involves the payment of dividends/profit share. This is a simple and understandable model, attractive for most investors, especially for traditional investment natives.

Due to the fact that 80% of the money now comes from large investors, it is not necessary to spend hundreds of thousands on your lending traffic, if you can more accurately work with large investors and funds. Moreover, the cost of buying traffic and publications grows even faster than the rate of some crypto-currencies.

The cost of conducting ICO, purchasing traffic and promotion on ICO trackers grows every month. Experts say that if in September 2017 it was possible to arrange an ICO for $60 thousand, in 2018 it costs at least $125 thousand. It becomes more difficult to attract investors, an increasingly important role is played by team personal participation in the promotion of the project and personal communication with major investors.

Summary

The current crowdsale model is still at the very beginning of its development and will face a large number of changes that will be bring more transparency, reliability and security, both to investors and projects themselves.

New forms of token offering are emerging, allowing projects to receive funds for the development of new ideas. Analysts compare today’s processes with the development of the Internet in 2000, the industry is starting to seek solutions to the real business tasks, more and more projects tend to register security tokens, as connecting your virtual token to real token is an additional confirmation of reliability for the user.

Even in a high-tech industry like the token market, no one has abolished natural selection — those who can build more proactive management and will be more effective in their work will survive. Given that at the moment more than half of the projects do not reach the set goal for fund-raising, it is obvious that there remains a huge field for improvements.

ICObazaar.com is one of the leading ICO trackers providing independent rating and reviews of trending ICOs since 2017. ICO listed database is 3000+ projects with over $ 1 bln raised.

ICOBazaar gives access to 120 000 active investors offering diverse marketing options for ICO owners.

This is a sponsored press release and does not necessarily reflect the opinions or views held by any employees of NullTX. This is not investment, trading, or gambling advice. Always conduct your own independent research.

CNBC |

Could the lack of volatility actually be good for bitcoin?

CNBC Craig Johnson, Piper Jaffray, on the next key levels for bitcoin. Is the cryptocurrency’s heyday over? With CNBC’s Melissa Lee and the Fast Money traders, Tim Seymour, Karen Finerman, Steve Grasso and Guy Adami. Watch CNBC Live TV … |

CNBC | Could the lack of volatility actually be good for bitcoin? CNBC Craig Johnson, Piper Jaffray, on the next key levels for bitcoin. Is the cryptocurrency's heyday over? With CNBC's Melissa Lee and the Fast Money traders, Tim Seymour, Karen Finerman, Steve Grasso and Guy Adami. Watch CNBC Live TV ... |

Members of the European Parliament have cast their votes overwhelmingly in favor of a new directive that introduces stricter countermeasures against money laundering across Europe — a move that will have consequences for crypto investors

Members of the European Parliament have cast their votes overwhelmingly in favor of a new directive that introduces stricter countermeasures against money laundering across Europe — a move that will have consequences for crypto investors

Members of the European Parliament have cast their votes overwhelmingly in favor of a new directive that introduces stricter countermeasures against money laundering across Europe — a move that will have consequences for crypto investors

There’s no simple way to put it. 2018 has been tough for the world of cryptocurrency. As most individuals who are currently invested made their start right before or during the bear market, which has been the longest in crypto since 2014-2015, it’s safe to assume that a large number of them have seen significant […]

There’s no simple way to put it. 2018 has been tough for the world of cryptocurrency. As most individuals who are currently invested made their start right before or during the bear market, which has been the longest in crypto since 2014-2015, it’s safe to assume that a large number of them have seen significant losses. While the first half of the year has been riddled with disappointment, there are a number of specific instances that have stood out as exceptionally so. Let’s take a look:

For those who got into NANO near the tail end of its record-setting 2017, when it saw greater returns than any other cryptocurrency, 2018 has surely been tough to swallow. NANO entered 2018 at all-time high prices above US$35 after spending most of the first half of the year trading for fractions of a cent, and since then, it’s fallen, hard. NANO currently trades around US$2.70, up slightly from 2018 lows of $2.50, but still more than 90% down from the start of 2018.

However, this movement should not discredit NANO itself. The unfortunate circumstances of the BitGrail shutdown, which saw much of the total supply of NANO stolen, combined with the initiation of the bear market, is largely to blame. The fee-less, instant-send NANO these investors got on board with has not changed, and hopefully it will begin to rebound in due time.

Telegram is practically essential for those involved in the space. Alas, when Telegram planned to hold an ICO, it caught the attention of everyone. The crowdsale for Telegram’s TON token was poised to become one of the largest ICOs of all time, potentially rivaling EOS’s record-breaking US$4 billion ICO.

Unfortunately, Telegram’s ICO never happened. After receiving US$1.7 billion from private investors, Telegram decided to can its public ICO, barring its millions of users from participating in its evolution. What made this decision even more disappointing was the precedent it set; more and more cryptocurrency startups are choosing to ditch the ICO model in favor of private alternatives, a move that flies in the face of the fundamentals of cryptocurrency.

Consensus is the biggest cryptocurrency conference of the year, and historically it’s been a very positive influence on crypto markets. 2017’s Consensus, the largest at that point in time, was shortly followed by the summer cryptocurrency explosion that saw adoption grow exponentially. Consensus 2018 was huge, with almost 9,000 participants, which was over four times the attendance of the year prior.

Unfortunately, attendees this year voiced concerns about a change in sentiment surrounding Consensus. 2018’s event was dominated by Lamborghinis, expensive watches, and worst of all, ICO pitches. Many complained that activities and conversations were centered around obscure and established ICOs looking to rope in private investors, rather than on the current and future implications of cryptocurrency and blockchain, as had been the case in years past. As a result, rather than slingshotting Bitcoin and altcoins upward, the mid-May conference preceded a 30% drop over the following months, returning markets back to their 2018 lows.

The mainnet launch of the US$4 billion “Ethereum Killer” ICO has been nothing short of a disaster. After multiple delays, the EOS mainnet finally launched last month. From frozen accounts, to abuse of power from the government-esque body of 21 block producers (BPs), to malicious behavior in promoting certain parties, to security breaches and network freezes, the launch of the fifth highest valued cryptocurrency by market cap has been a nightmare.

Hopefully, much of the previous woes will be eradicated moving forward. However, some of the core functionalities of EOS (the ability for BPs to freeze accounts and revert transactions, the anonymity of the producers, the lack of checks and balances on those who oversee the network, and so on) will not change, and that’s left speculators throughout the crypto space worried. Studies even suggest that EOS will likely be the victim of a major hack by the end of this year.

President Trump has signed an executive order establishing a new task force that targets consumer fraud, including those involving “digital currency.”

President Trump has signed an executive order establishing a new task force that targets consumer fraud, including those involving “digital currency.”

In the United Kingdom (UK), exciting advances for the blockchain industry are about to take place. It is one of the first demonstrations in a live deal that equity in a UK company can be tokenized and issued within a compliant custody, clearing and settlement system. FCA regulatory sandbox This is a result of the …

The post UK Testing New Platform in Preparation for a Crypto Future of Tokenized Assets appeared first on BitcoinNews.com.

In the United Kingdom (UK), exciting advances for the blockchain industry are about to take place. It is one of the first demonstrations in a live deal that equity in a UK company can be tokenized and issued within a compliant custody, clearing and settlement system.

This is a result of the UK’s open-minded Financial Conduct Authority’s (FCA) regulatory sandbox. It recently entered its fourth round and out of the 29 firms being released by the financial watchdog last week, ten were blockchain related. Two projects stood out so much that they are now in collaboration with the London Stock Exchange Group (LSEG) and the FCA.

One of these promising startups, 20|30, will be the first company to test a primary issuance of tokenized stock in September. According to 20|30, once the first phase of testing has been completed, there are plenty of other companies in industries such as pharmaceuticals, software and agriculture seeking to test the model.

The test will be conducted using a distributed ledger technology (DLT) platform developed by fintech company Nivaura which is integrated with the LSEG Turquoise platform. Nivaura most notably executed the world’s first fully automated cryptocurrency bond issuance in 2017.

In simple terms, the investment platform proposed by 20|30 is to be an easy, safe, and transparent process for approved investors to purchase equity tokens. The test on the LSEG’s Turquoise platform will allow for investors to place orders for equity tokens and matched orders will be cleared and settled on the blockchain.

The equity tokens that are to be issued are ERC20 tokens, meaning they are built on Ethereum. The trading of these tokens will occur presumably on an over-the-counter (OTC) basis once the one-year-long lock-in period has passed.

In a report made by CoinDesk, 20|30 co-founder Tomer Sofinzon said: “That’s absolutely possible… After the lock-in period, we can begin the next phase, to really test the tradability.”

Dr Avta Sehra, CEO and chief product architect at Navaura, also made some rather bullish comments to CoinDesk regarding the future of the industry.

Dr Sehra said, “The industry is going to become a world of tokenized assets – that’s inevitable. We don’t really care if its Ethereum or Bitcoin, the underlying infrastructure isn’t that important. But it is going to be a blockchain.”

Follow BitcoinNews.com on Twitter at https://twitter.com/bitcoinnewscom

Telegram Alerts from BitcoinNews.com at https://t.me/bconews

Image Courtesy: Pixabay

The post UK Testing New Platform in Preparation for a Crypto Future of Tokenized Assets appeared first on BitcoinNews.com.

As the world of blockchain continues to grow, so too does the number of opportunities to connect with and learn from individuals from all over the world, oftentimes through conferences. ChainXChange, which takes place from August 13th through August 15th in Las Vegas, is one such opportunity. The ChainXChange Expo is centered around AI, innovation, […]

As the world of blockchain continues to grow, so too does the number of opportunities to connect with and learn from individuals from all over the world, oftentimes through conferences. ChainXChange, which takes place from August 13th through August 15th in Las Vegas, is one such opportunity.

The ChainXChange Expo is centered around AI, innovation, and most importantly, blockchain technology. The convention will occupy 350,000 square feet of space at Mandalay Bay in Las Vegas from the 13th through the 15th. Over the course of the event, there will be over 100 breakout sessions focusing on educating, empowering, and ultimately immersing attendees in the world of blockchain, through the help of industry leaders and experts. The expo will also offer live music performances each night and, most importantly, keynote presentations by an all-star lineup.

The speakers will be giving keynote presentations regarding the “Seven Worlds of Blockchain” as defined by the event: Artificial Intelligence, Sports and Entertainment, Currency and Fintech, Logistics and Infrastructure, Health Care, Internet of Foods, and Nonprofit Organizations. Perhaps the most exciting speaker on the list is Steve Wozniak, co-founder of Apple. Wozniak, who has previously been vocal about his support and belief in the future of blockchain, will focus his presentation on the current and future implications of blockchain. He will also touch on artificial intelligence and other emerging technologies.

In addition to Wozniak, Nobel-Prize winning economist Paul Krugman will deliver a keynote presentation. Krugman, who has historically been an adamant opponent to Bitcoin, is perhaps the most unlikely name on the speaker’s list. Regardless, the opinions of a renowned individual such as Krugman who is more skeptical of the blockchain space provide a different and worthwhile perspective on the technology.

Beyond these two, Sam Walker, Deputy Editor at the Wall Street Journal, will give a presentation on effective leadership strategies. Writer and inspiration behind Molly’s Game, Molly Bloom, will speak about her past, and the value in taking risks and being bold. Robert Shapiro will present on building business around automation. Presentations will also be made by marketing guru Gary Vaynerchuk, Wired Editor-in-Chief Nicholas Thompson, Stanford Professor of AI and Blockchain Kartik Gada, and many others.

ChainXChange is also featuring a global innovation competition for each of the Seven Worlds of Blockchain. Based on innovation, impact, and application, the winning submission will receive the grand prize of US$100,000.

Musical performances will be headlined by Salt-N-Pepa, Kid ‘n Play, and Common on each of the three nights. Early bird ticketing and hotel bookings are still available through July 12th. Early bird tickets are priced at $995, but will increase to $1,495. For those looking to take a deep educational dive into the world of blockchain while immersing themselves among experts and leaders from around the world, ChainXChange is certainly an opportunity to consider.

New research suggests that prices for high-end graphics cards – coveted by both cryptocurrency miners and gamers alike – are falling.

New research suggests that prices for high-end graphics cards – coveted by both cryptocurrency miners and gamers alike – are falling.

With an estimated $100 billion value in sunken artifacts in the waters surrounding the Bahamas, deep-sea treasure hunters could soon satiate their thirst for a big bounty through blockchain technology.Using an ap…

With an estimated $100 billion value in sunken artifacts in the waters surrounding the Bahamas, deep-sea treasure hunters could soon satiate their thirst for a big bounty through blockchain technology.

Using an approach that tokenizes shipwrecked items found on the seafloor, the founders behind blockchain startup PO8 intend to revitalize marine archaeology in the region minus the kind of looting, corruption and lack of oversight that caused officials with the commonwealth government to put a halt to expeditions in the region for nearly two decades.

PO8’s model in adhering to responsible salvaging practices convinced the local government officials, as Chief Marketing Officer Raul Vasquez told Bitcoin Magazine: “Currently PO8 is the only government approved entity with a salvage license to do any underwater salvaging in territorial waters belonging to the Bahamas.”

Using an Ethereum-based platform along with ERC-721 token functionality, the PO8 model creates non-fungible tokens (NFTs) — tokens based on the collateral value of recovered items. Each NFT utilizes specifically designed smart contracts that are cryptographically certified with unique asset data. While NFT ownership can be to anyone in the world, the majority of PO8 artifacts remain in the custody of the PO8 Foundation.

“For example, let’s say PO8 finds a rare artifact worth millions,” Vasquez explained. “The physical artifact would remain under the custody of PO8 for continued study by the archaeology community or to be exhibited in museums for the larger public good, while the digital ownership of the NFT can be anywhere around the world. Now, the real ownership of an asset is determined by its NFT.”

Later this year, PO8 will be rolling out the PAZAR marketplace where users can buy, sell, auction, lease, trade and leverage the tokens. Land-based undersea explorers will also be able to contribute to the hunt with PO8’s DApp Maritime Artifact Data System (MADS), which serves in big data analysis around satellite images, sonar, image and video, electromagnetic and historic data. In exchange for their MADS efforts, contributors earn NTFs when users already hold PO8 tokens in their wallet as a demonstration of proof of stake in the system.

“Individuals, rather than corporations and governments, will play a more vital role in the recovery, conservation, exhibition and ownership of these artifacts,” a white paper available on the PO8 site states. “Decentralization of the industry will allow millions more to participate in the experience and bear witness to history encapsulated underwater for centuries. What was once only accessible to a few can now be shared with eager enthusiasts all over the world.”

With the recoveries, PO8 first pays the government, insurers and foundations their cut of the booty. From there, the organization sells 50 percent of the artifacts on its open auction platform. The other 50 percent stays with the foundation to be used in educational programs and traveling exhibitions around the world.

At the crux of PO8 is the establishment of a complementary fix for archaeologists and academics who see high value in maintaining shipwreck sites with commercial interests looking for a return on the high-dollar investments necessary to pull off underwater expeditions.

Only a handful of commercial salvage companies “have the financial backing to afford months, years and sometimes decades on the high seas in the treasure hunt of their lives,” according to the white paper. “For governments and the nonprofit sector, these high costs make it difficult to be active participants in exploratory excavations.”

PO8’s promotion of responsible commercial salvage includes building a team capable of carrying out the mission. Most recently, this translates to the addition of David Gallo, a 30-year oceanography veteran and one of the creators of the first detailed maps of the RMS Titanic, in the role of vice president for exploration. Gallo was also part of the successful international effort in locating the wreck site of Air France flight 447, which crashed into the Atlantic Ocean in 2009.

“To me PO8 is the most exciting project to come along in decades,” Gallo said in a statement. “It encourages the development of new technologies and techniques for undersea exploration and visualization. In doing so, PO8 will accelerate the ability to locate, document and protect the precious artifacts of Bahamian undersea cultural resources. The waters surrounding the islands of the Bahamas are not only rich with shipwrecks but also with unlimited treasures of the mind.”

Regarding PO8’s first exploratory mission, slated for Q3 2019, CEO Matthew Arnett only says the team is eyeing a couple target sites with “cargo manifests indicating the loads are significant in value.”

PO8 received its salvaging license from government officials in the Bahamas late in 2017. Since the start of 2018, the firm has focused on the development of its smart contracts and wallet. Beginning in the third quarter of this year, the crowdsource initial coin offering begins with registration most likely to begin in early– to mid-August, Vasquez told Bitcoin Magazine.

This article originally appeared on Bitcoin Magazine.

A manhunt is currently underway for a businessman that was kidnapped near his offices in Cape Town. According to some sources, a ransom of 50 Bitcoin has been demanded for the man’s return. Police Reluctant to Confirm Rumours of Bitcoin Ransom Demands According to a report in News24, Liyaqat Parker was kidnapped by five armed…

The post Bitcoin Ransom Demand Rumours Circulate in South African Kidnapping Case appeared first on NewsBTC.

A manhunt is currently underway for a businessman that was kidnapped near his offices in Cape Town. According to some sources, a ransom of 50 Bitcoin has been demanded for the man’s return.

According to a report in News24, Liyaqat Parker was kidnapped by five armed men at around 09:10 on Monday from his business in Parow, Capetown. Since then, rumours have circulated that a ransom has been made for his return.

The reports come from second local news source. Netwerk24 have reported that the ransom demand was made via email on Tuesday.

However, local police are reluctant to comment on the demands of 50 Bitcoin due to the “highly sensitive” nature of the case. Walid Brown, family spokesperson and lawyer, commented:

“I don’t have such information although I also saw the rumour.”

A spokesperson for the Western Cape police, Captain FC van Wyk added:

“This case is also investigated by our provincial detectives. Please bear with us as we cannot divulge details of the investigation that has yet to be presented before a court of law.”

Parker, 65, is a successful businessman in the Western Cape area. He is a founding member of the Food Property Group, as well as a member on the board at Al-Amien Foods. The kidnap victim also holds a high position at Brimstone Investment.

Family members made a heartfelt statement for their relative’s safe return on Tuesday afternoon:

“Our father and brother is an elderly man, so we also appeal to those who may be involved or know persons who may be connected with this crime, to just please release him unharmed before his health deteriorates.”

The plea continued, highlighting Parker’s commitment to his businesses, as well as local philanthropic causes. The statement mentioned his long-term involvement with the Children’s Hospital Association.

The Parker case isn’t the first incident of kidnapping involving a Bitcoin ransom in South Africa. In May of this year, NewsBTC reported on the case of 12-year-old Katlego Marite. In this example, those responsible demanded 15 Bitcoin be paid for the safe return of the youth. He was later returned to his family. Local police did not divulge the details of his return, however.

Elsewhere, crypto exchange employee Pavel Lerner was taken from outside his office in Kiev, Ukraine late last year. The demands of over $1 million in Bitcoin were met and Lerner was released three days after his ordeal began.

Featured image from Shutterstock.

The post Bitcoin Ransom Demand Rumours Circulate in South African Kidnapping Case appeared first on NewsBTC.

Even Pops has heard about the Internet of Things. And if he hasn’t, he’s probably used some device connected to it without realizing it. But they say that with great power comes great responsibility (or words to that effect), and that is sort of the premise behind the Identity of Things (IDoT). Last week, Malta […]

Even Pops has heard about the Internet of Things. And if he hasn’t, he’s probably used some device connected to it without realizing it. But they say that with great power comes great responsibility (or words to that effect), and that is sort of the premise behind the Identity of Things (IDoT).

Last week, Malta announced three new trailblazing laws regulating ICOs, blockchain companies, and DLT. But while this regulation is undeniably groundbreaking in itself, it’s just the tip of the iceberg. The Malta Blockchain strategy is entirely more holistic and includes six core projects. One of the most interesting of them involves IDoT.

IDoT is a way of ensuring that we manage the Internet of Things correctly as it grows exponentially in the years ahead. It involves assigning unique identifiers (UIDs) and metadata to every object and device (thing).

This will allow them to communicate effectively over the internet. It will also help prevent a situation in which autonomous devices have no one behind them to be held responsible if something goes wrong. IDoT, then, is essential to IoT’s success.

If anything imaginable can be addressed and networked online, it needs its own identity so that it can be found amidst the millions and potentially billions of ‘things’ out there.

Each entity must be unique and globally identifiable with, say, an alphanumeric string that is not associated with any other thing. IDoT involves several key considerations, including lifecycle, relationship, authentication, and context-awareness.

An electronic medical record (EMR), for example, would keep the same identity throughout the life of the person it pertains to. Other entities and things have shorter life cycles, such as a package being shipped, or a smart refrigerator.

When it comes to relationships, we need to know how IoT devices relate to each other. This includes the owner or administrator of each device, as well as any other responsible party.

Authentication still remains a challenge for IoT devices, since 2FA and biometrics are largely irrelevant here. We still need to find a solid way of securely authenticating IoT identities.

And finally, when it comes to context, the identity and access management of IoT devices need to be context-dependent. This means that not all entities can access all systems or other entities. In a situation where it may be inappropriate or even dangerous for a device to gain access, it’s vital that access control be monitored.

IDoT doesn’t only apply to ‘things’ connected in the stratosphere. It applies to people as well. In Malta, as part of its blockchain strategy, the government is planning to provide residents with e-residency and assign identities to legal entities. Efficient identity management using blockchains could one day remove the need for physical ID cards and passports.

IDoT increases in importance as IoT takes off. And it’s good to know that there are some solid brains gathering to figure out the best path ahead.