March 28, Berlin

Trinity Foundation has always been breaking new grounds in the development of the Trinity Network. The TNC cross-chain asset converter, released at the Beilin Conference, marks a significant landmark in Trinity’s broader application.

By using the TNC cross-chain asset converter, TNC can be converted to ERC20 (asset on Ethereum blockchain) from NEP5 (asset on NEO blockchain). We believe the conversion brings the following benefits.

- ERC20 TNCs can be used on more exchanges that only support Ethereum assets, thus increasing liquidity.

- Apart from buying on exchanges, we can get ERC20 TNCs by converting NEP5 TNCs.

- ERC20 TNCs will be an important economic tool for Trinity to expand its territory, i.e. what many people say “Trinity for Ethereum”.

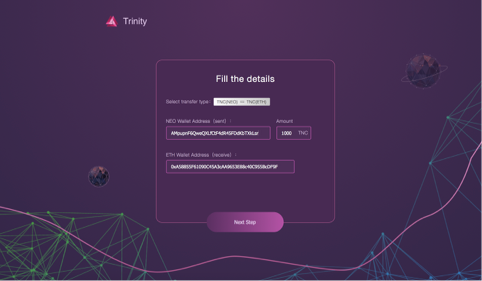

How to convert TNC assets:

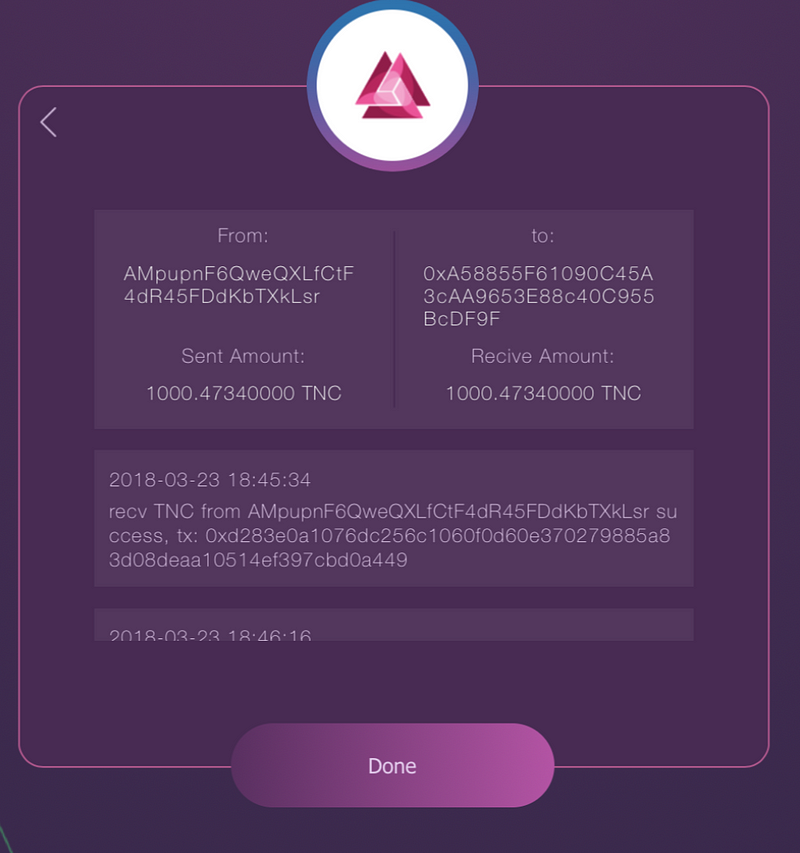

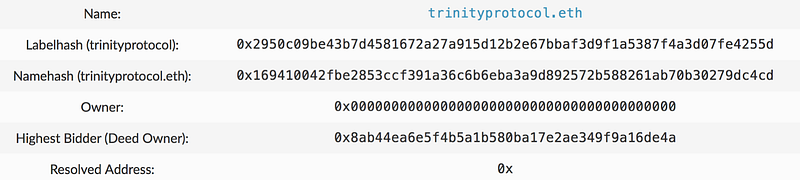

First, send NEP5 TNCs to the conversion address on Neo mainnet with the recipient address on Ethereum attached. Once confirmed by the cross-chain witness, TNC will be frozen by the Neo conversion address and the Ethereum conversion contract (for security purposes, we have deployed ENS address for confirmation, i.e. trinityprotocol.eth) will send equal amount of ERC20 TNCs to the recipient address that the user inserted before. It is the same process to convert ERC20 TNCs to NEP5 TNCs.

(Scan the QR code of the conversion address and transfer. Note that the amount you insert needs to be a little bit more than the actual amount as a random number to differentiate each transfer.)

(after transfer, waiting for confirmation by the witness, freezing and release of ERC20 TNCs)

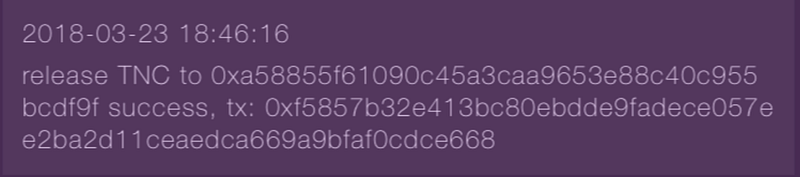

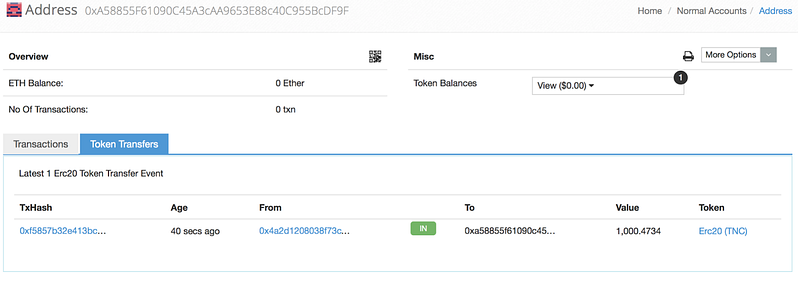

(ERC20 TNC released)

The amount of ECR20 TNCs (or the amount that trinityprotocol.eth has) is the same as that of NEP5 TNCs, which is 1 billion, but only 1 billion TNCs are in activation at the same time. For example, if 30% NEP5 TNCs are frozen and 70% are activated, then 30% ERC20 TNCs are activated and 70% are frozen. That’s to say, TNCs on Ethereum are not new tokens or add-issued tokens.

(Note that “frozen” here means that TNCs are frozen in the conversion address and has nothing to with the lock contract. )

At the current stage, for security reasons, Trinity Foundation is the only cross-chain witness to ensure that assets in all unsuccessful cross-chain transactions can be refunded. Although all transaction records can be checked on-chian, only Trinity Foundation has the right incentives to make sure operations can be undone and the conversion address is correct.

In the future, if there is demand for frequent Neo-Ethereum TNC conversion, we will offer such services and allow more nodes to be the cross-chain witness. But we need to point out that if there is no such demand, no one is willing to pay for this, and there is no economic incentives to allow other nodes to be the witness.

The above images show cross-chain conversion on Neo and Ethereum testnets. The official version will be released in about 2 weeks when users will be able to use it on trinity.tech.

Based on the feedback from our community, we will launch Trinity Loyalty Rewarding Initiative at the end of March, from which users can lock their TNC and get rewards after unlock. Please stay tuned for our announcement at the end of this month.

The Trinity Network has been significantly updated compared with its original design. Our 2nd edition testnet willl be released at the end of this month. Since its official release, Trinity is meant to be a fully decentralized and autonomous second layer network where ordinary people can participate and operate nodes to reap economic benefits.

We are promoting commercial landing of our project, especially building a closed ecosytem of dapp sdk, nft asset transaction and wallet. Before the release of our pilot project, we hope developers who are interested in this could contact us to discuss how to make a trade-off between decentralization and performance using second layer network.

Trinity Community:

https://t.me/TrinityStateChannels

Twitter:

@trinityprotocol

This is a sponsored press release and does not necessarily reflect the opinions or views held by any employees of The Merkle. This is not investment, trading, or gambling advice. Always conduct your own independent research.

March 28, Berlin Trinity Foundation has always been breaking new grounds in the development of the Trinity Network. The TNC cross-chain asset converter, released at the Beilin Conference, marks a significant landmark in Trinity’s broader application. By using the TNC cross-chain asset converter, TNC can be converted to ERC20 (asset on Ethereum blockchain) from NEP5 (asset on NEO blockchain). We believe the conversion brings the following benefits. ERC20 TNCs can be used on more exchanges that only support Ethereum assets, thus increasing liquidity. Apart from buying on exchanges, we can get ERC20 TNCs by converting NEP5 TNCs. ERC20 TNCs will

March 28, Berlin Trinity Foundation has always been breaking new grounds in the development of the Trinity Network. The TNC cross-chain asset converter, released at the Beilin Conference, marks a significant landmark in Trinity’s broader application. By using the TNC cross-chain asset converter, TNC can be converted to ERC20 (asset on Ethereum blockchain) from NEP5 (asset on NEO blockchain). We believe the conversion brings the following benefits. ERC20 TNCs can be used on more exchanges that only support Ethereum assets, thus increasing liquidity. Apart from buying on exchanges, we can get ERC20 TNCs by converting NEP5 TNCs. ERC20 TNCs will

On March 28 the Calvin Ayre-owned blockchain and mining firm, Coingeek, announced it would be funding the privacy-centric bitcoin cash (BCH) project ‘Cash Shuffle.’ The project Cash Shuffle is a mixer tool designed to shuffle BCH to increase transaction anonymity. Also read: China’s Huawei Rumored to Partner with Cold Storage Smartphone Maker Blockchain Firm Coingeek Funds […]

On March 28 the Calvin Ayre-owned blockchain and mining firm, Coingeek, announced it would be funding the privacy-centric bitcoin cash (BCH) project ‘Cash Shuffle.’ The project Cash Shuffle is a mixer tool designed to shuffle BCH to increase transaction anonymity. Also read: China’s Huawei Rumored to Partner with Cold Storage Smartphone Maker Blockchain Firm Coingeek Funds […]

Over the past few months, the company Coingeek has been investing in blockchain projects across the bitcoin cash ecosystem. The firm owned by the entrepreneur Calvin Ayre has been funding projects like

Over the past few months, the company Coingeek has been investing in blockchain projects across the bitcoin cash ecosystem. The firm owned by the entrepreneur Calvin Ayre has been funding projects like